What Is Managerial Accounting and How It Helps Managers?

.jpeg)

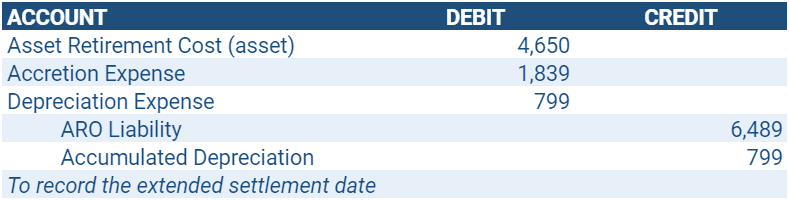

Moreover, recognizing unusual deviations from the estimated values and identifying the reasons behind such deviations are two other key focus areas of this management accounting technique. Cost accounting, budgeting, variance analysis, key performance indicators (KPIs), and decision analysis methods are some of the tools that can be used. The goal of management accounting is to aid decision-makers by providing accurate information about a business’s financial operations. Find out more about management accounting jobs, responsibilities, required competencies and salaries.

Cost Accounting

- Costs are also used to determine selling prices of products, and they are monitored over time to evaluate progress and discover irregularities.

- A business performance report is an important tool to stay on track a company’s mission.

- Managerial accounting analyzes the incremental benefit of increased production – this is called margin analysis.

The goal of a business is to generate profit, which is the difference between income and costs in a particular time period. Costs are the result of paying cash or committing to pay cash in the future in order to earn revenue. It is critical to analyze costs because controlling them directly impacts profitability.

.jpeg)

These frameworks provide guidance on recording and reporting financial transactions, ensuring consistency and comparability across reporting periods. This is particularly important for publicly traded companies, which must comply with regulatory requirements set by entities like the Securities and Exchange Commission (SEC). Balanced scorecards offer a comprehensive view of performance by integrating financial metrics with other key indicators, such as customer satisfaction, internal processes, and learning and growth. This holistic approach ensures companies consider longer-term objectives that drive sustainable growth.

These analyses are based on the budget of the company and business decisions are aimed at productively exploiting this. Managerial accounting is a branch of accounting that deals with the compilation of financial records for internal decision-making. It is also known as cost accounting or management accounting, and managerial accounting. Margin analysis is primarily concerned with the incremental benefits of optimizing production. Margin analysis is one of the most fundamental and essential techniques in managerial accounting.

Inventory Turnover Analysis:

As a result, cost accounting can help you do a profit analysis of your product line to see which items make the most money. The goal is to use the budget to help make short-term operational decisions that will help increase the company’s operational efficiency. Get started in your career by enrolling in an accredited program and building your skills with online courses. Consider the Managerial Accounting Fundamentals course offered by University of Virginia. However, this doesn’t make managerial accounting an “easy” branch of accounting, as it requires experience and considerable training to thoroughly understand what factors influence a business’s success or failure. Variance analysis is used to assess a business’s performance by comparing the planned or budgeted costs with the actual costs and identifying what is causing any deviations.

1: Introduction to Managerial Accounting Concepts

Performance measures such as return on equity, debt to equity, and return on invested capital help management identify key information about borrowed capital, prior to relaying these statistics to outside sources. It is important for management to review ratios and statistics regularly to be able to appropriately answer questions from its board of directors, investors, and creditors. Management accounting can be a fast-paced and rewarding career choice with various job opportunities. To qualify as a management accountant, you must complete training with a professional body.

Managerial accounting involves the compiling, analyzing, and interpretation of financial records for managers. Managerial accounting is important for drafting accurate and complete financial statements for internal use and crafting a company’s long-term strategy. Without good managerial accounting, corporate leadership can struggle to make appropriate choices or misunderstand the firm’s true financial picture. Because managerial accounting documents are not official, they do not have to conform to GAAP and can be used internally for a variety of purposes.

For instance, a technology firm might track metrics related to product innovation and customer retention alongside traditional financial ratios like return on equity (ROE) and gross profit margin. The salary ranges for management accountants will vary by factors like job title, industry, location, level of education, certification, and years of experience. According to Glassdoor, the estimated total pay for management accountants in the US is $111,514 per year. This figure includes an average base salary of $90,606 and $20,908 in additional pay.

Cost accounting is used to measure and identify those costs, in addition to assigning overhead to each type of product created by the company. Financial accounting must conform to certain standards, such as generally accepted accounting principles (GAAP). All publicly held companies are required to complete their financial statements in accordance with GAAP as a requisite for maintaining their publicly traded status. Most other companies in the U.S. conform to GAAP in order to meet debt covenants often required by financial institutions offering lines of credit.

Earning a bachelor’s degree in accounting, finance, business management, or a related field is the first step in becoming a management accountant. Many employers prefer a postgraduate degree since this is a management position within a company, so consider pursuing your master’s in management accounting if necessary. The performance of a whole company, each department and each employee are considered at the end of each term in performance reports. Under-performers are sometimes let go and individuals who achieve or over-achieve their goals are rewarded for their commitment to the business. Performance reports can show flaws in workflow setups if let’s say for example a whole department is somehow not performing to a certain capacity. A business performance report is an important tool to stay on track a company’s mission.

Managerial accounting helps company management make informed operational and business decisions. Capital budgeting primarily involves analyzing the details necessary to make capital expenditure decisions. For example, in the case of capital budgeting analysis, a company’s management accountants compute the IRR or internal rate of return and the NPV or net present value to help the managers make capital budgeting decisions. This practice encompasses various aspects of accounting that aim to enhance the quality of financial information sent to the management team.

Performance measurement evaluates the efficiency and effectiveness of an organization’s operations. This process systematically collects and analyzes data to assess how well a company is achieving its business goals. By employing various financial and non-financial metrics, organizations can gain insights into their operational strengths and weaknesses, enabling informed decision-making. Variance analysis compares actual performance against budgeted expectations, identifying managerial accounting areas for improvement.